CLICK ON CHART TO ENLARGE

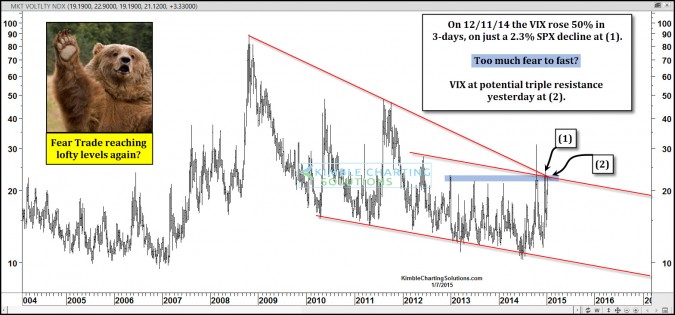

Can the VIX (Fear Trade) rise 50% in 3-days with the S&P 500 falling less than 3%? Is that possible? If that would happen, does that sound like a short-term extreme/panic from the investing community to you?

Well it did happen! Almost a month ago (12/11/14) the VIX did rise 50% in 3-days on small decline. (less than 3%)

The VIX had NEVER rallied this much (50%), on such a small S&P 500 decline, in the past 25-years! (See 50% VIX rallies here)

The chart above reflects a rally in fear since the first of the year, taking it to a price point at (2).

The Power of the Pattern shared with Premium Members yesterday that this could be a good price point where fear could take a short-term pause, due to the potential that triple resistance was in play at (2) above. Looked to be a good place to short fear (XIV), with a stop just above the triple resistance zone, in case fear breaks out.

What happens here could be very important friends due to this….The last two times the S&P 500 was down the first three days of a New Year was in 2000 & 2008 (only took place twice in 65-years) and we all know how those years turned out!

These were the only two times this took place (first 3 trading days down) since 1950, until this year! (See post here)

Even the ole Santa Claus rally this year, was the 3rd worst in the past 65-years.(See post here)

Should fear traders break resistance and close above (2), it would be the first time to do so, in the past three years. Big fear trade test is at hand right now and the results of the resistance test could have a big influence on how you might want your portfolio constructed the rest of the first quarter and into the end of 2015.

Stay tuned friends, the fear trade resistance test, looks to be more important than usual!

–

What services Premium Members Receive ….See Here

See more of our research at Kimble Charting Solutions.

-