Rate sensitive assets have experienced rare moves since July. Government bonds (TLT), Utilities (XLU) and Real Estate (IYR) have fallen hard, as interest rates have risen of sharply. Have rates hit a peak or are they just getting started, on a much greater move much much higher?

The 4-pack below looks at these “rate sensitive” assets and how they seem to be at important price points, from a Power of the Pattern perspective.

CLICK ON CHART TO ENLARGE

TLT, IYR and XLU have all declined the past few months and each are now testing multi-year rising support at each (1). Each remains inside of 5-year rising channels, despite the large declines.

One beneficiary of rising rates has been the financial sector, which has experienced a historical rally this month.

Full Disclosure- Premium Members were short bonds and long financials before the big moves recently. They have been taking gains off the table of late (selling financials and bond shorts), as these key inflection points are being tested at (1) & (2).

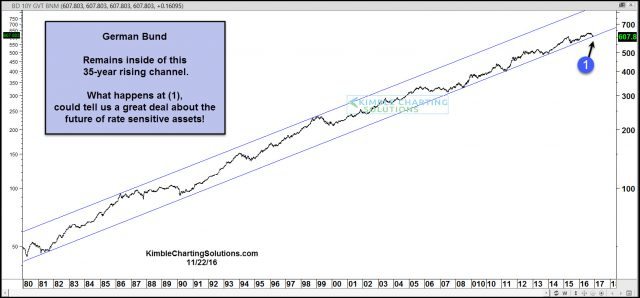

I humbly am of this opinion; what billions of free thinking people do at (1) and (2), could tell all of us, about the long-term trend in rates. Another key “rate sensitive” pattern is below, which is the 10-year German Bund, which we share with members weekly.

CLICK ON CHART TO ENLARGE

What billions of free thinking people do with the German Bund at (1), could tell us a ton about the long-term trend in rates!

On a personal note, I want to share that I feel blessed and Thankful for your viewership and support of this blog. I wish each of you a Happy and Blessed Thanksgiving week. Chris

–