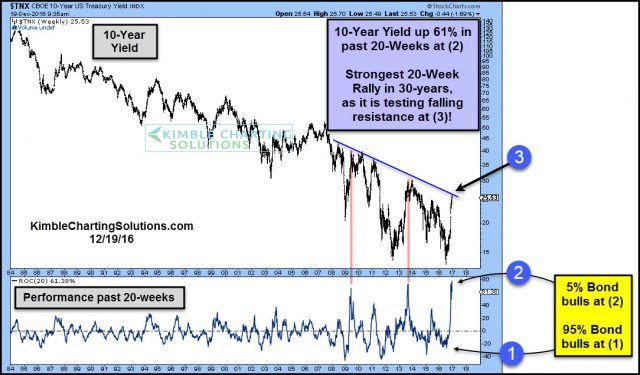

Have interest rates rallied in a “Big” way over the past 20-weeks? How about the largest 20-week rally in history! Have rates peaked in the short-term or going to continue higher?

Below looks at the yield on the 10-year note, over the past 30-years.

CLICK ON CHART TO ENLARGE

This past summer, the world was convinced that bonds were going to keep pushing higher and yields were going to stay low, as 95% of investors were bullish bonds at (1).

After experiencing the sharpest 20-week rally in history on the 10-year note, investors are feeling very comfortable that rates are going to keep pushing higher at (3), as only 5% of investors are bullish bonds at this time.

Sometimes the majority finds itself caught on the wrong side of the trade. The crowded trade in bonds in July was big time on the wrong side (being long, should have been short).

Now investors are comfortable getting out of bonds, after the historic rally, creating a crowded trade the polar opposite of this past summer.

The Power of the Pattern shared with members this past summer to short bonds at (1), when 95% of investors are bullish bonds. The patterns that are in play, suggest to be thinking the opposite of the crowded trade again!