A good deal of talk going around the street since the election last year, has revolved around the “reflation theme!” Below looks at a couple of charts that could be suggesting that the reflation theme could be peaking.

First we take a look at the price pattern Ole “Doc Copper” is creating.

CLICK ON CHART TO ENLARGE

Copper so far, continues to make a series of lower highs over the past 6-years. Copper hit three year falling resistance at (1) and has backed off in price. While hitting this resistance, Copper has created three different bearish reversal patterns (bearish wicks) and potentially a head & shoulders topping pattern. This week Doc Copper could be putting the finishing touches on the right shoulder at (2).

The key to this pattern now? Can Doc Copper remain above the neckline, just below (2). IF support does not hold here, selling pressure could increase.

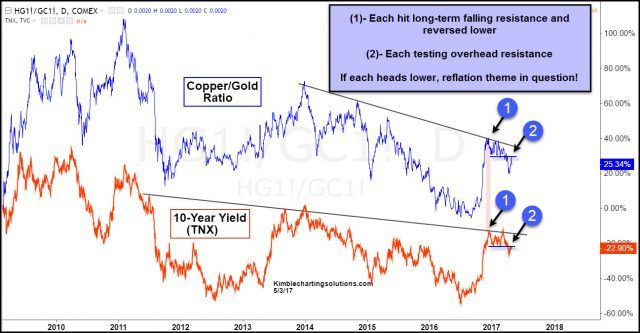

Below looks at the Copper/Gold ratio and the yield on the 10-year note.

CLICK ON CHART TO ENLARGE

If the reflation/growth theme is to continue (be the real deal), Ole Doc Copper, 10-year yields and the Copper/Gold ratio needs to breakout to the upside, not be putting in lower highs and acting weaker.