What We Do For You

I am truly honored by your interest in learning how my research can help you.

I am truly honored by your interest in learning how my research can help you.

My strategy consists of four words: TOPS, BOTTOMS, NO MIDDLES or TBNM

I look for patterns at extremes that have a high probability for a reversal or breakout.

My intent is to simplify the decision making process. I am an Occam’s Razor fan and want to “shave away” all unnecessary information.

Click Images Below to Enlarge

In keeping with the theme of Occam’s Razor, below shares three simple, unemotional and effective ways I help members capitalize on the Power of the Pattern.

I LOOK FOR OPPORTUNITIES TO BUY ON SUPPORT, OR BUY ON A REVERSAL OFF OF SUPPORT

I WILL HARVEST AND/OR MOVE STOPS UP AT RESISTANCE TO PROTECT GAINS.

AND WHEN A BEAR PATTERN FORMS, I MAY SHORT OR BUY A INVERSE FUND.

We are NOT bulls or bears.

We ARE bullish on opportunities based on the pattern.

We will look to go long an upside “bullish” breakout ” and we will look to sell to preserve capital or potentially short a downside “bearish” breakout.

Either way, we are looking for opportunities to increase or preserve capital. The examples below show some of our favorite patterns we look to identify for you to capitalize on.

Upside Breakout “BULL” Patterns

Downside Breakout “BEAR” Patterns

I began my career in as a financial advisor back in 1980. For the majority of these years I was fortunate to have the wind of a bull market behind me. It made me look rather smart to my clients during those years. I was also fortunate to have met Sir John Templeton, founder of Templeton Mutual Funds in the late 1990s.

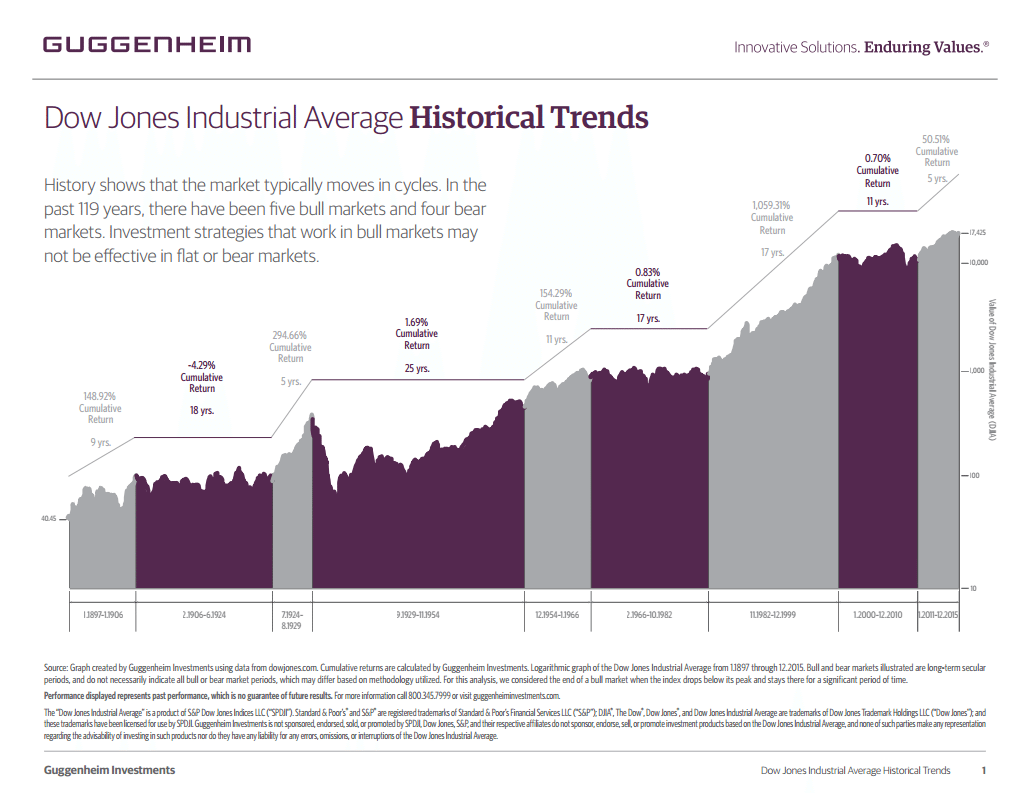

Sir John quickly became my hero as well as a mentor. He informed me the greatest bull market of all time was likely ending at the end of the decade! How did he know? John Templeton was born in the early 1900s and had personally experienced several long term bull and bear markets. Through great observations of market history and its tendency to repeat certain patterns, he was able to capitalize in the worst and best of times. It made me look at investing very differently going forward. First, that a major bull market pattern could be in for a long nap, a sideways market perhaps for a decade or two! (think of the nap you take after a thanksgiving feast)

Market history & the reality of repeating patterns

I could not simply hold and hope at this point. Sir John said – “if you do what everybody else does, you’ll get what everybody else gets”. We have to expect some pain with investing but I didn’t want my clients to suffer. In addition, should Sir John’s observations come true again and we found ourselves in a sideways market that included some very significant declines, I needed a system or approach that could help manage the downside risk if not capitalize on it. My goal was to boil decisions down to a simple yes or no, in or out and eliminate the what-ifs and noise. I realize investing is not always that precise and simple.

Taking things back to the mid 1990s for a moment, I was familiarizing myself with a software program called MetaStock. Having studied technical analysis during this time, I began applying various moving averages to help mutual funds I had assets in at the time. Over time I realized moving averages were useful only when definitive trends are in place but can eat you alive when things trend sideways for a period of time. This ultimately led me to the approach I’ve adopted since. I call it TBNM or Tops, Bottoms and No Middles. I look for patterns at extreme points of “exhaustion” with a high probability of reversing. Perhaps you are familiar with some of the terminology such as rising and falling wedges, “cup and handle” patterns etc. Finding these patterns is my skill and passion. What matters most is knowing that these patterns increase our odds of success. I’ve also found these patterns provide another very important benefit – simplicity and clarity to help eliminate all the noise from an unlimited number of opinions and news the world provides.

Beyond the pattern, we still need to choose position size, a stop loss method and targets. What I can share about those who have employed my research is that it’s helped people make decisions with greater ease and confidence. What I can also promise you won’t see from me is any focus on the problems of the world. My sole focus is on finding solutions, patterns that provide opportunities to increase account values regardless of market direction; what I often refer to as the “Power of the Pattern”.

By now you should also be able to conclude that I’m neither a bull nor a bear. I am of the belief that being “bullish or bearish” is nothing more than a psychological state of mind……. It’s not a strategy. I attempt to find repeating patterns that have a two-thirds chance of predictable results. No matter how hard I work I know I will be wrong a third of the time and I am OK with that….yet I am NOT ok with “Being wrong for long”!

I used to do a lot of day trading, which was too stressful. But now I start to calm down and do more swing trades with a lot more confidence and less stress.And thanks for all the timely communications, that I truly appreciate. You have a wonderful weekend.

Seeing your take is a way for me to stay rational about expectations and to get hints as to change of trends in different markets. I want to try using your charts to trade deliberately and rationally, instead of shooting from the hip when I get too busy to take a deep breath and see what the charts are saying,